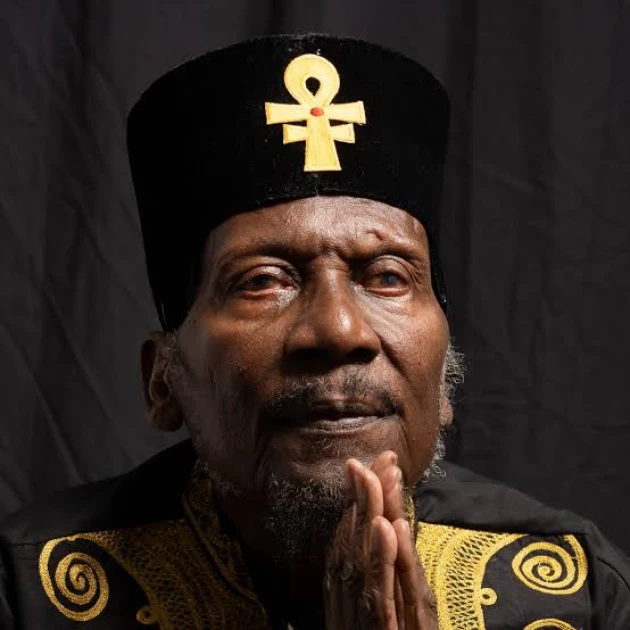

Elder fraud is where fraudsters target your parents, grandparents and those from the elderly community. Fraudsters often take advantage of those who aren’t tech-savvy, so familiarizing yourself with scams can lead to preventing the fraudsters from being successful.

Cybersecurity expert Brandon King from Home Security Heroes has compiled a list of tips to spot and prevent fraud. Fraudsters target seniors in elder fraud by tricking them into giving sensitive information or offering fake financial benefits.

Perpetrators could be strangers or known to the elderly, like family, friends or colleagues, and victims can lose their savings and suffer devastating consequences. Older adults are a prime target for fraudsters.

They normally target victims in retirement or close to retirement as they have a steady income, excellent credit history and more savings than younger people. The most common scams for elders to look out for:

- Grandparent scams: Scammers often pose as the victim’s grandchild to dupe seniors into sending money urgently for emergency expenses like overdue rent or car repairs. They often ask for secrecy, and in one case, an elderly woman was scammed of $20,000 by someone posing as law enforcement in 2019.

- Romance scams: Romance scams often target women 50 and above, but men can be victims too. Scammers will usually target seniors who have lost their spouses and are looking for companionship. An example of would-be perpetrators requesting money transfers or gift card vouchers sent to an email address.

- False charity scams: Fraudsters may pose as representatives from a real charity or create fictitious charity organizations. They can make calls, text, or send emails. In some cases, they may even visit seniors in person. False charity schemes commonly happen after a significant event, like a health crisis, global socio-political campaigns, or a natural disaster.

Protecting seniors from scams is crucial, as scammers use various methods to steal personal information and money.

Elder scams include fake medical schemes, investment scams, and phishing emails, taking advantage of the complexity of the healthcare system and seniors' fixed income. To avoid falling victim, seniors and their loved ones should research charities, verify emails and phone calls, and be cautious of unsolicited requests for money or personal information.

Additionally, seniors should beware of insurance coverage scams, romance scams, government impersonation, sweepstakes and lottery scams, identity theft, and tech support scams. Taking precautions and being aware of these scams can help prevent them!

Tips to prevent seniors from being scammed:

- Stay connected to your loved ones to prevent isolation, which makes them more vulnerable to scams.

- Warn them never to share sensitive information and explain why.

- Help them create strong, unique passwords and avoid reusing them.

- Limit online shopping to trusted retailers and check for secure websites.

- Never click on suspicious links in emails, social media messages, texts, or take calls from fake caller IDs.

- Monitor monthly banking statements for signs of identity theft or unauthorized accounts. Shred statements before disposing of them.

- Protect social media accounts by only accepting friend requests from people they know, updating privacy settings, and using multi-factor authentication. Delete messages from strangers and avoid odd payment types.

- Encourage your parents to name you as a Trusted Contact Person to speak with their financial advisors if there are concerns.

- Warn other family and friends if one of your loved ones has experienced a scam attempt. Discuss how to prevent fraudulent attempts.

If an elderly person you know has been scammed, it's important not to panic and to stay calm.

Document everything that has happened, including phone call logs, text messages, and emails, and report the scam to the Federal Trade Commission (FTC) and the person's bank and credit card providers. File a report with the local police and change all passwords to stronger ones, including social media accounts and investment profiles, setting different passwords for each site and enabling 2-Factor Authentication.

Elders can often be vulnerable and isolated; they may not be as tech-savvy therefore are targeted by fraudsters. It’s essential to maintain social contact with your parents and grandparents and educate them about how times have changed.