The potential introduction of a digital pound could have significant ramifications for the traditional banking sector, according to Professor David Skeie, Finance expert from Warwick Business School.

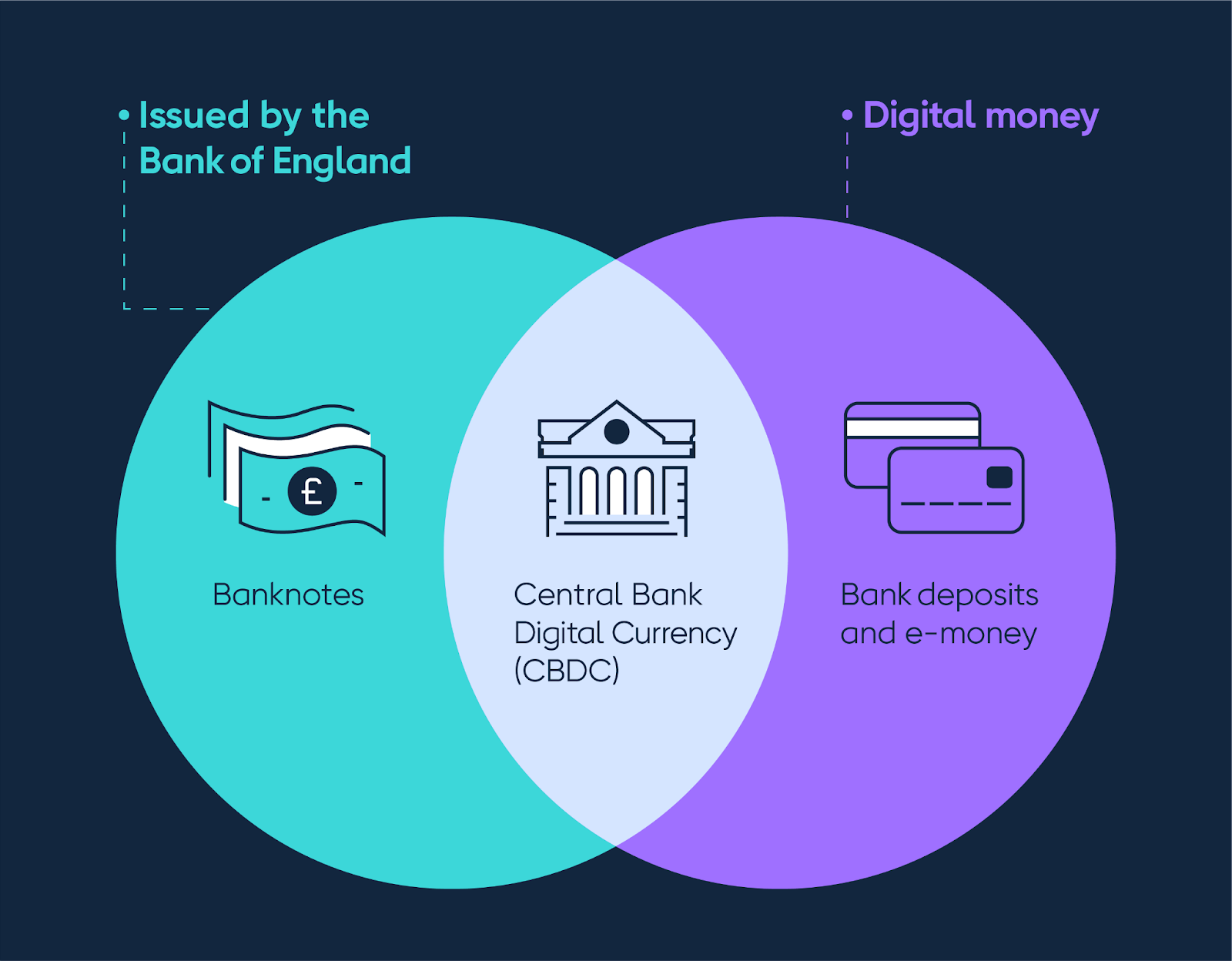

Professor Skeie explains: “Put simply, the idea is that individuals would be able to deposit funds digitally with the Bank of England, through a payment interface provider (PIP), in much the same way as they do currently with physical cash and banks.

“Crucially, though, this set-up could operate without the involvement of a bank or financial institution at all, unlike more established initiatives such as Google Pay or Apple Pay that act as a digital layer ultimately tied to individuals’ bank accounts.” With ongoing discussions and a consultation paper released by the Bank of England and HM Treasury in early 2023, the concept of a digital pound is gaining traction.

However, Professor Skeie cautions that the shift could pose considerable risks to commercial banks. “The idea of a digital pound represents a transformative change in how we interact with money,” said Professor Skeie, who is also affiliated with the WBS Gillmore Centre for Financial Technology.

“While there are benefits, such as improved efficiency and potentially lower costs for consumers, commercial banks must be vigilant about the challenges it presents.” Professor Skeie elaborates on the potential fallout: “If a tech company or PIP gains dominance, it could attract large amounts of money from commercial bank deposits.

“This shift could force banks to seek more expensive wholesale borrowing, making essential services such as mortgages and loans more costly and impacting the broader economy.” The risk of a dominant tech player issuing its own stablecoin is another concern.

Such dominance could lead to higher fees for merchants and control over the digital ecosystem, exacerbating the issues already seen with data privacy and financial sovereignty. The potential for a digital pound to influence financial stability is also notable.

During times of financial distress, individuals might rapidly shift their funds to digital providers, potentially triggering a run on commercial banks and exacerbating their financial instability. “While the digital pound could address some issues related to stablecoin valuation and financial stability, its introduction must be carefully managed,” Professor Skeie warned.

“The Bank of England’s proposal aims to ensure that £10 in digital pounds equals £10 in physical currency, helping to preserve monetary value and prevent instability.” Professor Skeie emphasises the urgency for banks to prepare for these changes.

He said: “There’s a degree of complacency among banks regarding their traditional products. However, to stay competitive, they must embrace digital innovation and integrate technological expertise into their management structures.”