Energy giant npower has started to make positive changes to its services for vulnerable customers in debt, benefiting thousands of children and young people from families struggling to make ends meet across Worcester. This is a direct result of The Children's Society's Debt Trap campaign, which received support 6,000 from members of the public.

The Children's Society has campaigned for energy companies to 'show some warmth' to families with children who are struggling to pay fuel bills. As part of the campaign, a progress report was produced for each of the 'big six' energy companies including npower, which reveals positive changes that have been made to support families with children, and young people who live independently. The report also highlights further steps companies could take to reduce the impact of energy debt on vulnerable families.

As a result of the Debt Trap campaign, npower now includes 16 and 17 year olds who live on their own as a 'vulnerable group', meaning they will be better protected and receive increased support. Npower has also changed its telephone scripts to ask customers experiencing financial difficulties whether they have children living at home, so that responses can take into account the additional needs these vulnerable families may face.

Rob Willoughby, Area Director West Midlands said: "Though energy companies - including npower - have shown progress, much more can be done to help protect the health and stability of children in vulnerable homes. Companies like this must continue to work with families struggling with energy debt so that no child is faced with growing up in a cold, damp home. We must work together to end the damaging impact debt can have on a child's life."

The Children's Society continues to work constructively with npower to ensure all low-income families with children are classed as 'vulnerable customers'. The charity hopes that families will be offered appropriate support if they fall behind with bills, and are referred to free debt advice charities and expert advisors as soon as they fall into financial difficulty.

The Phoenix Newspaper UK | Latest news in UK | Positive news | Inspiring The Next Generation

Inspiring The Next Generation

The Phoenix Newspaper UK | Latest news in UK | Positive news | Inspiring The Next Generation

Inspiring The Next Generation Related Items

Latest News

- Petition sent to Buckingham Palace to save UK's oldest India...

- BCU invests £500k in new film and photography equipment...

- Beguile introduces ‘Golden Kiss’ — A radiant new fragrance c...

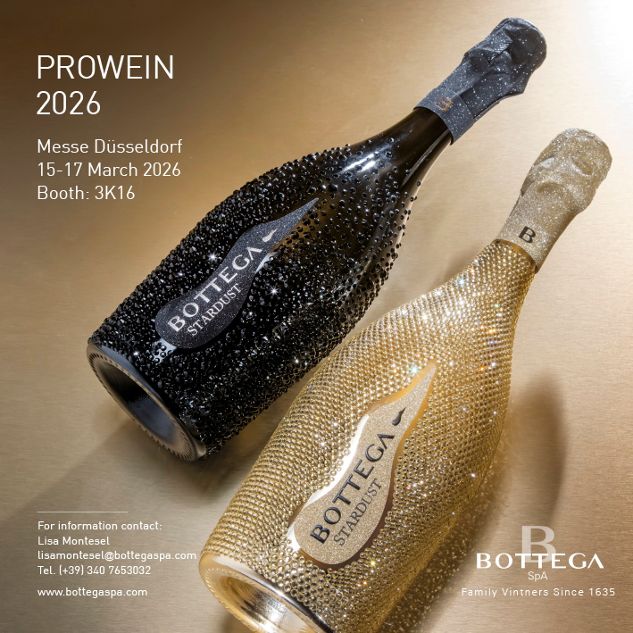

- ProWein: Bottega presents the no/alcohol collection...

- BMW Group UK and Ireland names 2025 Retailers of the Year...

- Second stage of United Oil exploration in Jamaica completed...

- Senegal’s Petrosen heads to Caribbean Energy Week to collabo...

- Hartpury University supports ECB with national cricket ‘fan ...

- Africa’s $29.5T mineral wealth poised to boost mining sector...

- Birmingham medtech company Eyoto breaks new ground across th...

- Grey expands global business banking with new USD-based paym...

- Ship & Shore Environmental, Inc. launches advanced dust coll...

- SICPA secures major European award for United Kingdom (UK) V...

- Council invests additional £250,000 to help fight fly tippin...

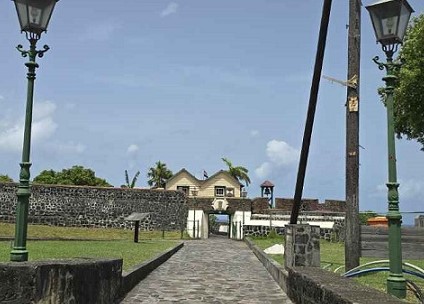

- St. Eustatius launches global tourism campaign with Caribbea...