Mortgage Advice Bureau in Birmingham, has launched a dedicated Mortgage Information Support Service to help homeowners who are worried about their finances as a result of the Coronavirus (COVID-19) outbreak.

The free support service, which is available to homeowners in Birmingham, has been set up to answer any queries or worries local people may have about paying their mortgage, and to guide them back to financial security.

To speak to a qualified mortgage adviser via the support service, homeowners should call: 0121 431 2468.

Mortgage Advice Bureau has also created an online resource of FAQs on the topic. This will be updated daily as more queries are raised.

In an ever-changing economic climate, the UK government is responding daily with new measures to minimise the impact of the Coronavirus, not only on our health, but our finances too. This includes access to a mortgage payment holiday of up-to three months for those worst hit financially by the virus.

However, this may not be homeowners’ only worry regarding monthly finances and with the new Mortgage Information Support Service, Mortgage Advice Bureau is answering people’s most common questions around managing their household finances to help them cope.

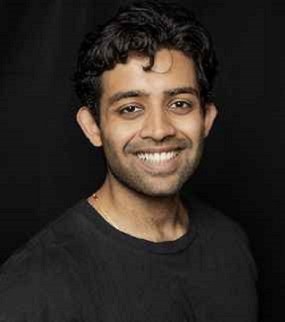

Raj Bedi, Business Principal, explains further: “We are living in unprecedented times and some homeowners are rightly worried about their finances. With a mortgage typically being a homeowner’s largest outgoing, monthly mortgage payments are naturally going to be homeowners’ biggest concern. We’ve set up the Mortgage Information Support Service to help local people through this challenging period and to offer advice to those who need it most.

“The helpline is managed by our fully qualified mortgage advisers who can provide guidance about what to do if repaying a mortgage is a worry during the Coronavirus outbreak. As the situation changes in the UK and across the globe, it’s difficult for people to foresee how their monthly income will be affected, particularly for homeowners on short-term, temporary or zero-hours contracts.

“The government is doing its best to help people during these difficult times and we certainly take financial well-being very seriously, so we are also doing our upmost to support people. We hope that the helpline will allow homeowners to talk openly and get them back on track with their finances.”