Midlands hospitality venues are showing positive signs of a return to growth as lockdown restrictions ease, according to two leading accountancy experts with Azets, Europe’s biggest regional accountancy and business advisor to SMEs. However, the top 10 accountancy firm forecasts long-term challenges for the sector amid unpredictable market conditions.

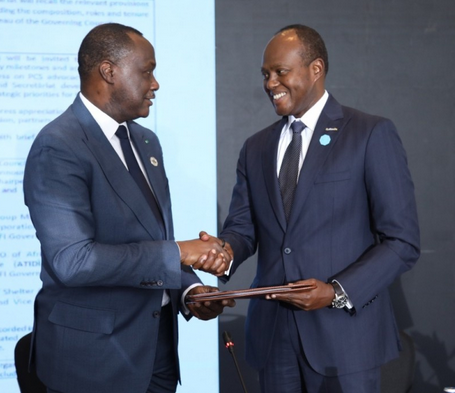

Citing the re-opening of two significant venues in Birmingham, James Martin, Restructuring & Insolvency Partner with Azets Birmingham, believes the region’s most popular hospitality businesses are primed for an accelerated recovery, with reduced capacity re-openings starting to make a difference.

Iconic Birmingham landmark The Grand Hotel re-opened its doors in May after 18 years closed. The 141-year-old building in Colmore Row has undergone a £45 million investment, bucking the trend of hotel closures in the wake of COVID-19. Another popular venue just off Colmore Row, South American restaurant Fazenda, reopened in May after agreeing terms on its former site - weeks after announcing it was shutting permanently following the extended lockdown.

James Martin believes current social distancing measures are preventing hospitality businesses from accelerating a recovery quickly but predicts a buoyant sector once all COVID-19 restrictions are lifted. However, he has urged cautious optimism due to continued volatility and the uncertainty of these timelines.

James said: “There are plenty of examples of closures within the hospitality sector and no doubt more to follow – particularly venues without an existing reputation or prominent location. However, the signs are good for the region’s most popular restaurants and hotels, and those with higher footfall in city centre locations, with reduced capacity bookings filling up and the country due to unlock in July.

“The re-opening of The Grand Hotel after nearly two decades and last-minute reversal of the decision to close Fazenda demonstrate opportunities exist – but market conditions do remain challenging and unpredictable, and there are no guarantees businesses that have survived this long will continue to do so in the future.

“Hospitality operators that rely on fixed cost premises may already have substantial rent arrears and other COVID-19 related debt. UKHospitality recently reported that the sector has £2.5bn in rent arrears alone due to the pandemic, further compounding the millions of pounds borrowed through the various COVID-19 loan schemes made available last year.”

Mark Selby, National Head of Corporate Finance with Azets, has called on hospitality businesses to seek professional advice to understand their financial position early, with uncertainty across the sector likely to remain for months and even years.

Mark said: “Businesses of all shapes and sizes in the hospitality sector need to undertake a financial health check to assess the viability of their models in the context of their new balance sheet structures, which look significantly different now than they did 15 months ago. It’s important these businesses seek professional corporate finance advice early, rather than wait until more challenging restructuring steps are needed.”