Recent international measures designed to cripple the Russian economy could stymie efforts by Jamaica to collect millions of U.S. dollars in future bauxite levy revenues from UC RUSAL at a time when the aluminum giant already has a backlog of monies owed.

Even before the invasion of Ukraine, the country’s mining ministry revealed that only late last year did the company begin settling its bauxite production levy debt to the Government of Jamaica that has been outstanding since 2018.

Based on details of a payment plan presented in the ministry’s press release, 18º North estimates that after the US$13.7 million payment by the company in November, representing about 40% of the debt, the amount still owing would be somewhere between US$16 – $18 million, or J$2.5 – $2.8 billion, assuming other monthly payments since then.

Observers say the prospects of collecting that revenue would dim even further if U.S. sanctions, previously lifted on the company in 2019, get reimposed.

After meeting with high-level officials in the U.S., Jamaica’s Prime Minister Andrew Holness said that he is satisfied that the country’s bauxite assets “are safe”.

He said that the topic of UC RUSAL did come up, but not in any of the official meetings. He declined to go into detail until he made a public statement about his visit.

According to the readout given to the press by the U.S. Treasury Department, Mr. Holness, Finance Minister Dr Nigel Clarke, and Foreign Affairs Minister Kamina Johnson Smith met with Treasury Secretary Janet Yellen to discuss the impact on Jamaica of the commodity shock triggered by Russia’s brutal invasion of Ukraine, including the President’s decision to tap the Strategic Petroleum Reserve.

“We don’t have any comment beyond the readout,” wrote Treasury spokesperson Alexandra LaManna when asked whether the issue of UC RUSAL came up and whether the U.S. encouraged Jamaica to apply sanctions against any Russian entities or persons. As to whether the U.S. Treasury was thinking of re-imposing sanctions on companies like UC RUSAL, she replied, “We don’t preview our sanctions.”

In 2018, as punishment for the Russian government’s occupation of Crimea, malicious cyber activities and attempt to subvert Western democracies, the U.S. Treasury sanctioned the likes of Oleg Deripaska and his companies, including UC RUSAL and EN+ Group, which has a controlling interest in UC RUSAL. The U.S. outlined that Mr. Deripaska had claimed to have represented the Russian government in other countries and acknowledged having a Russian diplomatic passport.

During that time, the company’s operations known locally as Windalco were grinding to a halt, according to the country’s shadow minister on mining Phillip Paulwell. “None of the Jamaican banks would deal with them,” he recalled.

“They were on the brink of shutting down in Jamaica.” Globally, there was fallout too as the price of aluminum shot up and supplies ran low. And in a deal with the U.S. Treasury in 2019 so the companies could get out of sanctions, Mr. Deripaska resigned his board seat and reduced his majority holdings in EN+ to 44.95% from about 70%.

Mr Paulwell did say that he didn’t expect sanctions to be re-imposed this time around. But, if they do, then it would be wishful thinking that the GOJ [Govt. of Jamaica] would be paid outstanding levy amounts.

Even without sanctions, Stuart Burns, co-founder of online platform MetalMiner, wrote in an email; “the current situation will definitely impinge Rusal’s ability to pay its bills around the world, and even more so will make them cautious in making payments even when they can – in order to conserve cash.” In addition to the revenues from the bauxite levy, Windalco also pays royalties and income taxes and directly employs about 1,200 people in Jamaica.

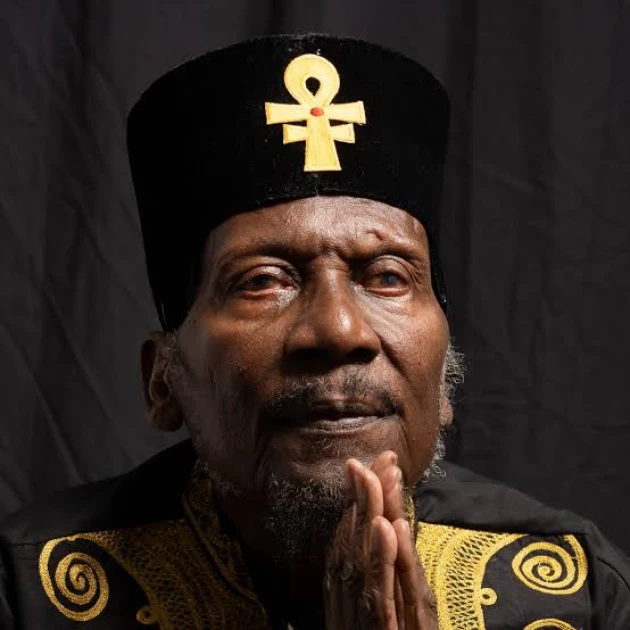

John Levy, General Secretary of the Union of Clerical Administrative and Supervisory Employees which represents about half of the workforce said: “Short-term it’s very concerning.” He’s been trying to get clear answers from the company and the government, to no avail. I don’t know if they’re waiting on Moscow, Washington…” he said.

Windalco also has beef cattle and dairy farms in the parishes of St. Ann and Manchester, and is responsible for as much as 14% of the country’s total milk production through its dairy farms, according to the Jamaica Dairy Development Board. Chair Derrick Deslandes said that he doesn’t expect the impact of any international penalties to be significant, but they were looking at options to mitigate the fallout from any potential sanctions to the milk sector (Local production represents only about 10% of overall milk-product consumption since the sector relies mainly on imports).

While Mr Deripaska’s companies appear to have avoided sanctions for now, the noose is tightening around the billionaire, who remains personally sanctioned in the U.S. Since the Russian invasion of Ukraine this year, the U.K. has added him to the sanctions list because of his pro-Kremlin stance and for being “closely associated with the Government of Russia and Vladimir Putin.” So too has Australia, where UC RUSAL has operations.

Kern Alexander, author of the book, Economic Sanctions: Law and Public Policy, said as the war drags on and eventually ensnares other countries in Europe, it may only be a matter of time before companies linked to Mr Deripaska become sanctioned again.

“It’s almost preposterous to say Deripaska doesn’t have control in EN+ or UC RUSAL,” the American professor of international financial law and regulation at Queens College, Cambridge University in England said given Mr. Deripaska’s still- significant holding. “Sanctions are for companies that are under the influence of sanctioned persons.”

In response to shocking images of dead civilians in Ukraine circulating on social media, Western leaders began to ratchet up the economic pressure on Moscow even more.

The E.U. said it would ban imports of Russian coal – its first on any import of energy from Russia – and the U.S. is now preventing dollar-denominated debt payments from the country’s accounts at U.S. banks to try and drain its international currency reserves and potentially push the country into default. But as Reuters analysed; “it has become clear that the easiest options are now exhausted and stark differences have emerged among allies over next steps.”

That could mean Europe limiting imports of Russian oil and natural gas, which could drive up energy prices for the West but would be sure to hurt Moscow. It could also mean that UC RUSAL, as one of the world’s largest suppliers of aluminum, becomes a target for economic penalties in a year when prices for the metal have hit a record high.

“I don’t see Rusal being sanctioned…but nothing is impossible,” explained Mr. Burns who remembers the “chaos” last time in the global aluminum market when the company was first penalized. But he says Europe is talking about stopping Russian oil and gas purchases “that would have a similarly significant impact on the much larger energy market.”

And in Australia, even though UC RUSAL has not been formally sanctioned there, that country’s recent ban on exports to Russia of alumina “will seriously hamper” the company’s raw material supplies. Last month, chair of the powerful House Committee on Financial Services Maxine Waters in the U.S. Intelligence said that she was in favour of re-imposing sanctions on UC RUSAL, calling out specifically its ownership of bauxite assets in Jamaica.

The Holness-led contingent also met with Rep. Waters and Gregory Meeks, Chairman of the U.S. House Foreign Affairs Committee in Washington, but neither of the two representatives’ offices responded to emails asking if sanctions against UC RUSAL were discussed. Prof Alexander says even if the companies become designated again, they could still be allowed a license to operate in Jamaica if the U.S. can confirm the profits won’t go back to Russia.

There are other options as well. Bloomberg reported that parent EN+ is considering carving out the international assets of UC RUSAL to create a new company which would be owned by management and non-Russian investors.

UC RUSAL officials wouldn’t comment to 18º North about how long they could sustain the operations if sanctioned. For now, the government-run Jamaica Bauxite Institute confirmed that since the US$13.7 million payment in November toward the backlog, there have been subsequent payments from the company, which is required to keep current on its payments.

The mining ministry, despite multiple requests, has not confirmed the exact size of the debt. But with some international banks now reportedly wary of dealing with Russian companies, and UC RUSAL potentially choosing to withhold payment amid pressure on the Russian economy, observers say as far as future transfers to the Government of Jamaica, there could be some risk.