According to PwC’s latest Global Entertainment & Media Outlook 2015-2019, the UK Entertainment and Media market is expected to grow by 3.2% compound annually from 2014-2019 to a value of £66.6bn in 2019. In 2014, the UK had the second largest E&M market across Europe, the Middle East and Africa at £56.9bn, behind Germany, and will maintain this position until 2019.

Phil Stokes, UK entertainment and media leader at PwC, said:

“Revenues from digital look set to reach a 50/50 share with non-digital in 2020, with the biggest revenue generators in digital being internet access and internet advertising, and the fastest growing digital sectors being TV advertising, out-of-home advertising and book publishing.

“Increasingly, though, it’s clear that consumers see no significant divide between digital and traditional media - what they want is more flexibility, freedom and convenience in when, where and how they interact with their preferred content.

“Having a digital strategy is not as compelling as having an overall strategy that’s fit for a digital age – one that marries together online and offline experiences for consumers.”

Newspapers – the print v digital dynamic

Newspaper advertising revenue has always been the greatest contributor to total newspaper revenue – but the divergence between traditional advertising and digital is growing. Over the period 2014 – 2019, print advertising is forecast to fall by £290m (-18%) in stark contrast to digital ad spend, which is expected to grow by £71m (30%).

The drop in print advertising mirrors a downward trend in print sales and circulation – with 467,000 fewer newspapers expected to be sold by 2019, a 23% fall over the five year period.

With capability of digital apps continuing to evolve and people’s appetite for online news showing no signs of abating, the Outlook anticipates online news subscriptions growing by 82%.

Internet access

Mobile internet access is set to overtake fixed broadband in 2017, increasing by an annual growth rate of 7.1% to reach £7bn by 2019, the highest in Western Europe.

Internet advertising

The UK will maintain its position as the largest internet advertising market in Europe, with a compound annual growth rate of 10.6% forecast over the next five years, rising from £7bn in 2014 to £11.7bn in 2019.

The fastest growth will continue to be seen in mobile advertising. 2014 saw a 58% increase in revenues and looking ahead, we will see a compound annual growth rate of 25.4% taking revenues to £5bn in 2019.

E-books

Consumer e-book revenues are forecast to grow at a compound annual growth rate of 20% over the next 5 years, from £466m (26% of total consumer book revenues) in 2014 to reach revenues of £1.2bn (57% of the total) in 2019. In 2014, e-books accounted for 22% of total books revenue (consumer, educational and professional) and this will rise to 47% by 2019.

Phil Stokes added:

“We continue to forecast that consumer e-books will overtake print/audio copies in 2018. Self-published e-books have continued to see strong growth with consumers finding e-books for £2 to £3 increasingly attractive compared with £6 to £10 for major bestsellers.

“Part of the popularity of e-books is their price and convenience. However, with more reading taking place on devices, publishers will increasingly have to compete with video, music and game content for attention.”

Consumer books print/audio revenue is expected to decline 8% annually over the next five years, falling from £1.3bn in 2014 to £867m in 2019.

Phil Stokes concluded:

“The entertainment and media industry is at the forefront of the digital revolution. It’s time to embrace the fact that mastering the user experience is critical to success in this industry. In a world that’s in beta, today’s entertainment and media companies need to do three things to succeed: Innovate around the product and the user experience, develop seamless consumer relationships across distribution channels and put mobile (and increasingly video) at the centre of their consumer offerings.”

The Phoenix Newspaper UK | Latest news in UK | Positive news | Inspiring The Next Generation

Inspiring The Next Generation

The Phoenix Newspaper UK | Latest news in UK | Positive news | Inspiring The Next Generation

Inspiring The Next Generation Related Items

Latest News

- Africa’s $29.5T mineral wealth poised to boost mining sector...

- Birmingham medtech company Eyoto breaks new ground across th...

- Grey expands global business banking with new USD-based paym...

- Ship & Shore Environmental, Inc. launches advanced dust coll...

- SICPA secures major European award for United Kingdom (UK) V...

- Council invests additional £250,000 to help fight fly tippin...

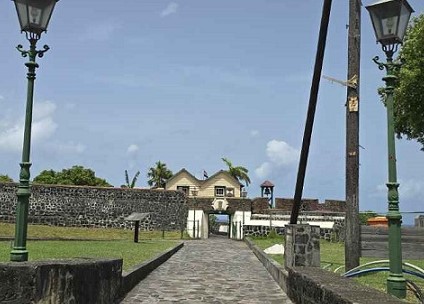

- St. Eustatius launches global tourism campaign with Caribbea...

- New Rolls-Royce extension building reaches landmark moment...

- 16-yr-old Nigerian, Jared Ejiasian, breaks 60m hurdles world...

- Akums strengthens European and UK presence — India's largest...

- Bereaved man back in the swim of thing through regular exerc...

- Mt Mulligan Lodge unveils new spa and wellness experience...

- Shaping a Human-Centric Future for AI – AI Impact Summit 202...

- Tourism & Takeoffs: Caribbean leaders head to Bermuda for hi...

- U.S. Supreme Court strikes down global tariffs in win for to...